Movrs Address Preparation and Validation System (MAPvS) is used to prepare the Annual Motor Vehicle Address/Taxing Unit file and validate vehicle owner addresses in the MOVRS Daily Download file.

There are many reasons to have accurate addresses: emergency response, mail & package delivery, maintenance of public & legal documents, etc.

For County Treasurers there is another significant reason: Tax Distribution. When collecting and distributing taxes, it is imperative that taxes are assigned to the correct address and the address be assigned to the correct taxing unit. A wrong address/taxing unit assignment will result in money being sent to the wrong city/township/school/etc.

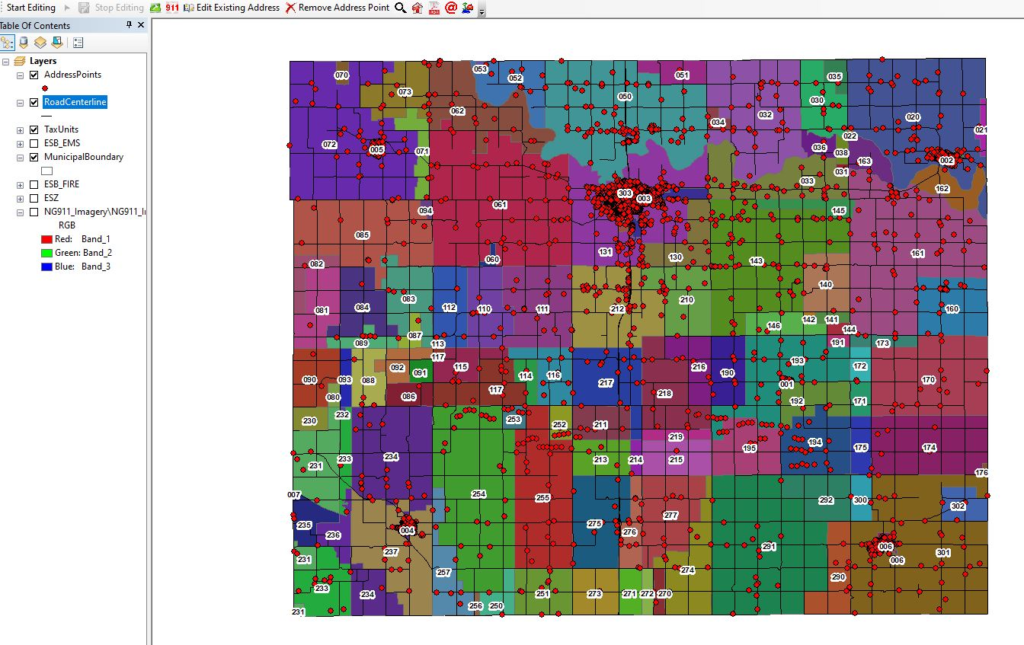

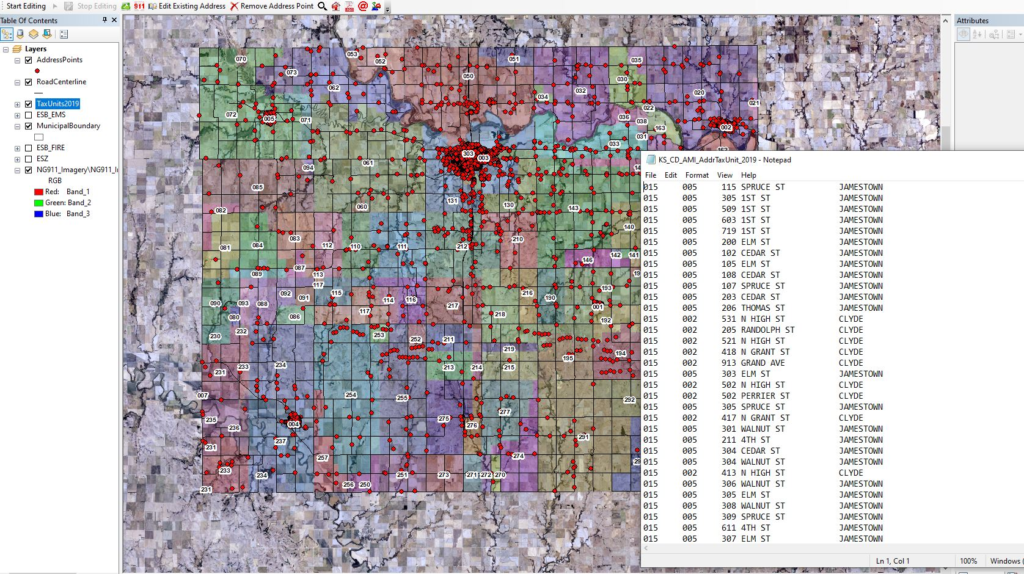

Prepare Motor Vehicle Address/Taxing Unit file.

County Treasurers use the MAPvS and NG-9-1-1 files to annually refresh the State’s vehicle address database.

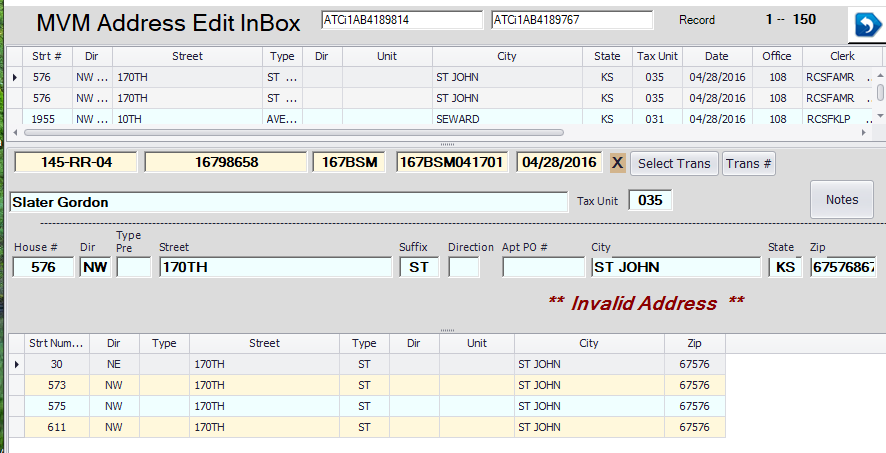

Verify Owner Address/Tax Unit Codes for Daily Downloaded Vehicle Transactions

County Treasurers match vehicle owner addresses to NG-9-1-1 addresses to ensure accurate addresses and tax units are assigned to vehicle transactions.